The Arab League Dream: Why It Never Became the EU

By: Fayzeh Abou Ardat / Arab America Contributing Writer

Attempts to replicate the EU and Eurozone integration model in the Middle East face persistent structural, political, and historical obstacles. Fayzeh Abou Ardat, an Arab America contributing writer, explores why the region, despite sharing a language and culture, remains divided and marked by rivalries. The Arab League, founded in 1945, once showed potential for EU-style unity but has since diverged sharply. Explaining this failure requires examining the region’s political, economic, and institutional shortcomings.

The Arab League: A Missed Middle Eastern Union?

The Arab League aims to strengthen Arab state ties, coordinate policies, and protect member states’ independence, sovereignty, and mutual interests. From the outset, many supporters expected it would lay the groundwork for deeper integration. They envisioned economic and even political unification like the EU’s European Coal and Steel Community (ECSC). However, unlike the ECSC and, eventually, the EU, the Arab League did not establish binding processes or strong supranational organizations. It lacked enforceable laws, a united market, and a common currency, and decisions were often non-binding.

Internal conflicts, competing national interests, and a lack of political will have frequently hampered the Arab League’s effectiveness. Instead of encouraging cooperation, the League often became a forum for rhetorical gestures with little to no substantial follow-through. During times of crisis, such as the 1990 Iraqi invasion of Kuwait or the Syrian civil war, the League was either divided or acted too weakly to have an impact.

Why the EU Model Worked in Europe

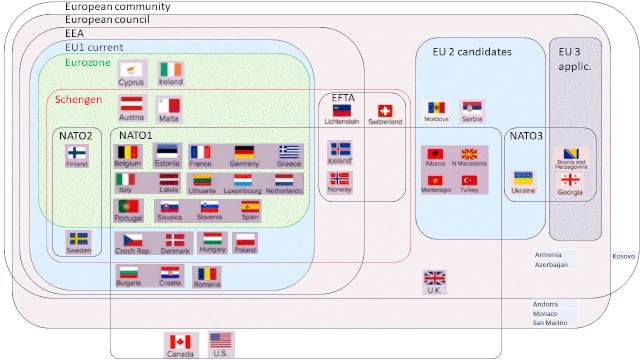

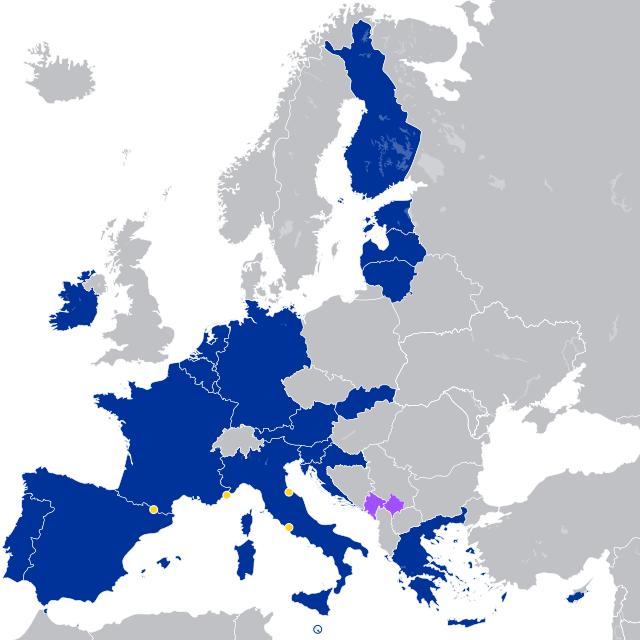

To understand why a similar model has not taken hold in the Middle East, consider why it worked in Europe. Following the devastation of World War II, Western European states were strongly motivated to promote peace, restore their economies, and fight Soviet expansion. The United States supported European integration under the Marshall Plan, which was pushed by strong Franco-German leadership. Over the decades, institutions like the European Commission, European Court of Justice, and European Central Bank strengthened their roles in EU governance. They now effectively enforce laws, coordinate monetary policy, and resolve cross-border disputes.

Shared democratic values, growing economic interconnectedness, and a cultural shift toward multilateralism enabled such integration. Crucially, European states were willing to share sovereignty in new ways.

Why the EU Model Is Unlikely in the Middle East

In contrast, Middle Eastern countries lack many of the requirements for such integration. Several main causes stand out:

Authoritarian Politics and Sovereignty Concerns

The vast majority of Middle Eastern governments are either authoritarian or semi-authoritarian. Unlike European democracies, authoritarian governments are extremely wary of handing up even minimal authority to regional bodies. Many dictators rely on strict domestic control for legitimacy, opposing the EU’s principles of shared governance, democracy, and rule of law.

Deep Geopolitical Rivalries

Europe has promoted Franco-German reconciliation to foster regional unity and stability. In contrast, the Middle East remains divided by enduring rivalries, Saudi Arabia and Iran, Turkey and the Arab world, Egypt and the Gulf, alongside internal conflicts in countries like Lebanon and Iraq. These rivalries are often rooted in ideological, theological, or sectarian divisions, such as Sunni versus Shia, secular versus Islamist, and Arab versus non-Arab. Such divides complicate efforts to reach a regional consensus.

Lack of Strong Institutions

The EU’s greatest strengths lie in its institutional framework, which comprises a powerful Commission, a Parliament, a court system, and regulatory agencies. The Middle East lacks similar regional agencies with enforcement powers. The Arab League and other regional organizations, such as the Gulf Cooperation Council (GCC), are consultative at best and frequently crippled by internal conflict.

Colonial Legacies and Borders

Colonial forces imposed many borders in the Middle East that did not accurately reflect ethnic or tribal realities. This has led to ongoing debates about identity and legitimacy within and between governments, making regional solidarity challenging. Europe, on the other hand, largely overcame its colonial baggage by integrating into an equal community.

The Missing Middle Eastern Eurozone

The Eurozone, a monetary union of 20 European Union countries that share the euro as their common currency, is one of the most sophisticated forms of regional integration in contemporary history. It is based on common fiscal principles, a centralized European Central Bank (ECB), and monetary policy coordination across very different countries. In theory, such a model could provide significant benefits to the Middle East by stabilizing currencies, reducing transaction costs, and enhancing economic interconnectivity. However, in actuality, the region has yet to build something similar.

Lack of Macroeconomic Convergence

Economic convergence is a prerequisite for entering the Eurozone; countries must meet tight standards for inflation, interest rates, budget deficits, and debt levels. These measurements vary across Middle Eastern countries. Wealthy, oil-dependent Gulf states like Saudi Arabia and the UAE often maintain substantial budget surpluses and economic stability. In contrast, conflict-affected countries like Lebanon, Syria, and Yemen are plagued by debt, inflation, and currency volatility. These economic differences render it impossible to coordinate monetary and fiscal policies effectively.

Absence of a Centralized Monetary Authority

The European Central Bank is responsible for managing interest rates, inflation, and money supply in the Eurozone. There is no institution like this in the Middle East. The Gulf Cooperation Council (GCC) initially proposed the establishment of a regional central bank and a common currency. However, the plan was halted due to political disagreements—particularly between Saudi Arabia and the UAE—over the location of such an organization. A unified currency is unsustainable without a credible and independent central authority.

Political Tensions and Distrust

The Eurozone functions because member states trust one another to follow (more or less) agreed-upon regulations. Mistrust and antagonism in the Middle East, which are frequently compounded by ideological and sectarian divides, impede such cooperation. Countries are unwilling to accept the loss of sovereignty that comes with currency pooling, especially if they are concerned about economic manipulation or dominance by regional powers such as Saudi Arabia, Iran, or Turkey.

Different Economic Structures

The EU’s economy centers on services and industry, while many Middle Eastern nations depend on oil exports, causing economic asymmetry and potential instability in the region. A regional currency would struggle to accommodate these opposing economic cycles. For example, a severe drop in oil prices has a different impact on Gulf states than it does on oil-importing countries such as Jordan and Egypt. Without fiscal transfer mechanisms (which are limited in the EU), these inequalities would cause instability within the union.

What a Middle Eastern Eurozone Would Require

Several significant changes would be required for a monetary union similar to the Eurozone to function in the Middle East. Countries would need to coordinate their macroeconomic policies, including inflation and interest rates, as well as fiscal discipline while establishing a politically autonomous regional central bank. Binding legal structures and reputable organizations would be required to enforce norms and resolve disputes. Wealthier countries would also have to support economic solidarity mechanisms, such as fiscal transfers to poorer economies. Most crucially, political reform, conflict resolution, and trust-building would be required. Without peace, accountability, and shared governance, a common currency cannot be established.

Political divides, authoritarianism, and weak regional institutions have hampered the Middle East’s ability to emulate the integration seen in the EU or Eurozone. The Arab League sought to unify Arab states, but it lacked binding authority and efficient cooperation. Deep mistrust, economic disparity, and persistent disputes have stifled genuine cooperation. A Eurozone-style system would necessitate considerable reforms, such as macroeconomic alignment, robust institutions, effective conflict resolution, and shared sovereignty, none of which are currently present. Without trust, stability, and political will, the concept of a unified Middle Eastern system is unrealistic.

Want more articles like this? Sign up for our e-newsletter!

Check our blog here!